Text verification – What is text verification? How to get text verification aboard?

In the digital age, where privacy and security are paramount, text verification plays a crucial role in ensuring that users are who they claim to be. Let’s delve into what text verification is, its significance, and how you can obtain it, especially when traveling abroad.

Digital security is a matter of concern in an era of ever-evolving technology. A recent study revealed extremely surprising information that Nearly 20% of passwords worldwide are compromised by criminals. This underlights the need for businesses to rely on more than just usernames and passwords to verify a user’s identity.

Today, adding more verification steps is critical to keep fraud at bay. Enter SMS verification is a simple, effective, and authentication solution that’s popular all over the world. Let’s find out information about this verification: What it is? How it works? How it can help your business minimize cybersecurity risks related to compromised credentials?

What Is Text Verification?

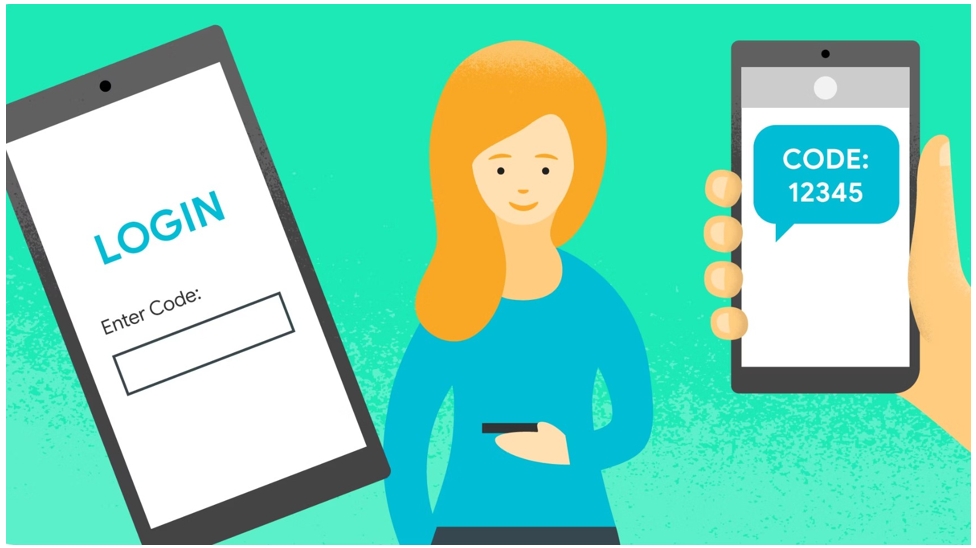

Text verification confirms a user’s identity through a verification code sent via text message.

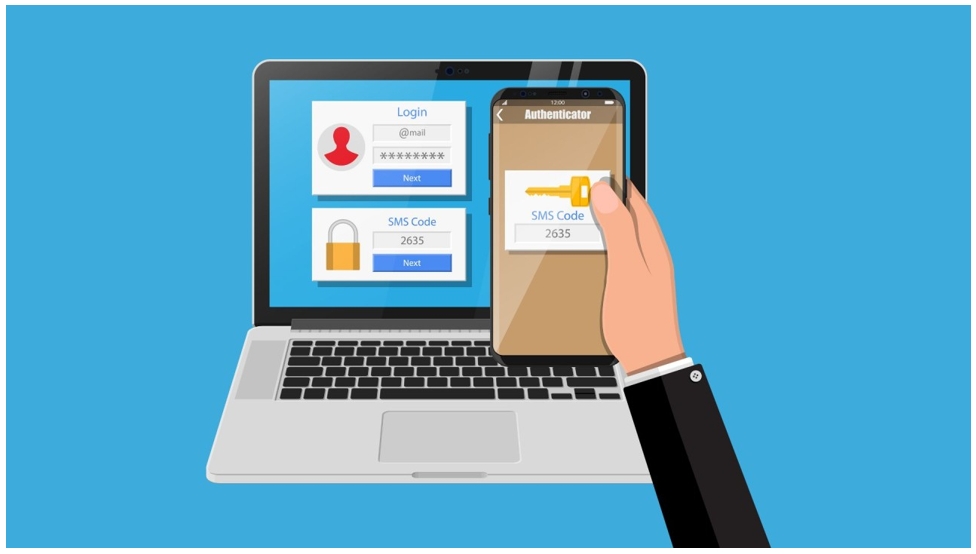

Text verification is a process that confirms a user’s identity through a verification code sent via text message (SMS). It adds an extra layer of security to login processes, account sign-ups, and other sensitive transactions. Here’s how it works:

- User Action: When you log in or perform certain actions (such as changing account settings), the system triggers text verification.

- Code Delivery: A unique verification code is sent to your registered phone number via SMS.

- Code Entry: You enter this code into the platform to complete your login or transaction.

How Text verification works

From an end user’s perspective, Text verification looks like the following:

Text verification provides a code to verify the right account owner

Receive a code: After entering a username and password, users will get a quick text message that contains a numeric. It is a time-sensitive and one-time code.

Enter the code: Users open this message and enter the code in a website, app, or any digital platform that need to use. This step verifies they’re the right account owner.

Access granted: After they enter the right number, the owner’s identity will be confirmed in the system. And they’ll be granted access to the account.

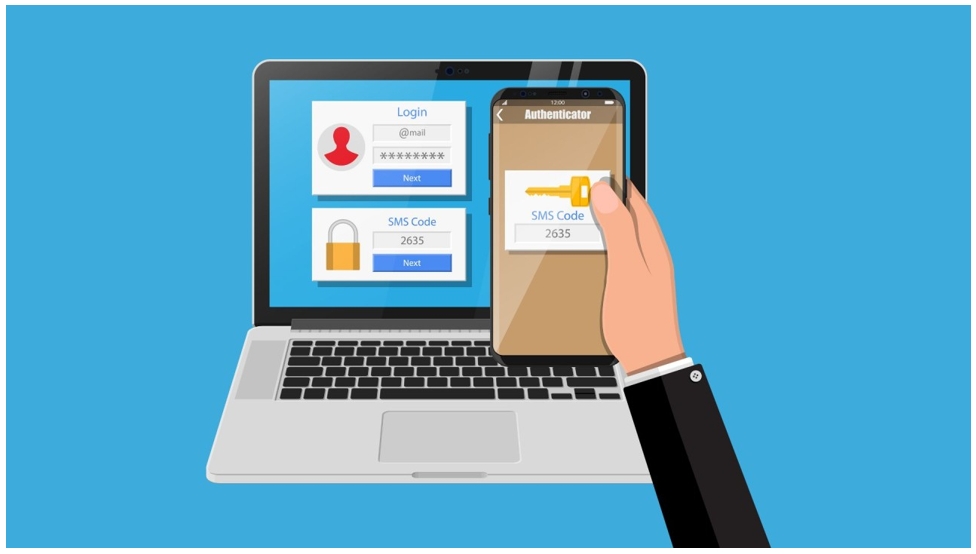

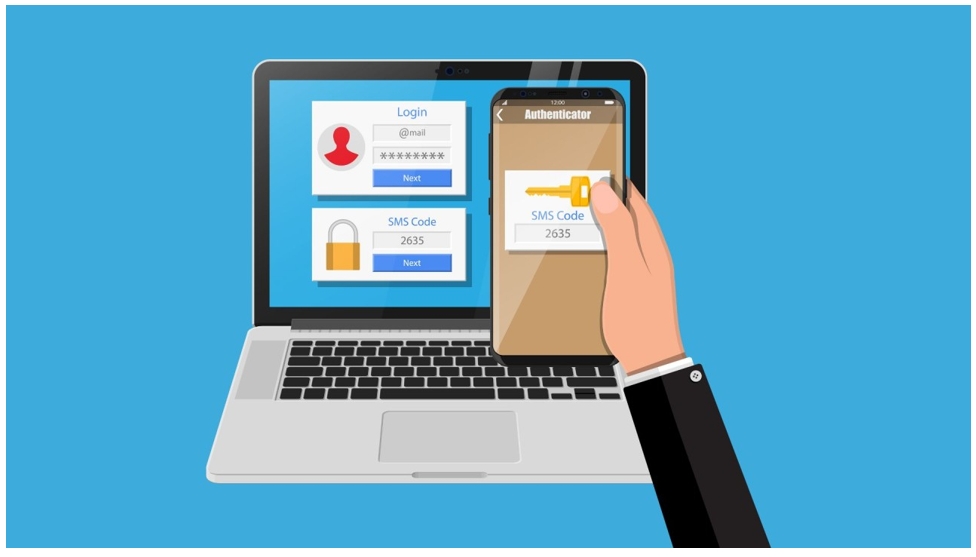

How SMS verification works example from BrickBank

By verifying via text message, a code is sent to a user’s mobile phone, which they enter into a designated field on a website or app to ensure privacy for access. You should always be careful if you receive a text verification code you didn’t request.

Is text verification secure?

SMS verification isn’t an easy way, it’s a good method to keep online accounts and digital interactions more secure.

While this verification lacks full encryption, it still offers a solid level of security and is better than using no protection in place. SMS OTPs are usually good prices and widely accessible, making them a popular and convenient option for many users. Therefore, while SMS verification isn’t an easy way, it’s a good method to keep online accounts and digital interactions more secure.

A secure alternative to text verification could be using mobile authenticator apps like Google Authenticator or Microsoft Authenticator. However, these apps require separate setup and management. And their availability might be less widespread compared to Text.

Real-life examples of SMS verification

Now you probably understand what SMS verification is and how it’s used. Let’s go through some real-life examples of businesses using it for account verification in banking, technology, and food delivery.

Text verification in banking

In the world of banking and finance, SMS verification adds a layer of security. This helps banks have confidence in their digital institutions – a must in today’s online world.

SMS verification is the method by which Triodos Bank – a world leader in sustainable banking, ensures the security of customer accounts. When there’s an attempt to log in to a user’s online account or mobile app, the Bank sends an OTP to that user’s registered mobile number. This way helps them easily verify any user’s identity.

Text verification in SaaS and technology

SaaS and technology companies often rely on opportune notifications to keep users in the loop and ensure the best experience for customers. In the case of EasyPark Group – a leading global parking tech company, they use SMS verification to send timely notifications to customers and let them know that their parking is running out of time. This adds an extra step of security in their app login process and ensures that the messages reach the right person.

This has been an incredibly important part of their customer communications strategy. Adding this verification to their app has increased their conversion rate – or the number of people who successfully entered the correct OTP code – by about 7%.

Text verification to reduce account fraud

Each new account is sent a verification code via SMS message.

Have you ever been in a situation where your brand is offering promotions to new users? But then you find out some people are creating multiple fake accounts to use discount codes many times. That trouble is exactly why AIQFOME – one of the largest food delivery platforms in Brazil, decided to implement SMS verification via Android and iOS.

Now, AIQFOME can verify all new registrations when customers create new accounts. Each new account is sent a verification code via SMS message when they sign up and ensures that the phone number to receive text can only be used once.

This authentication method can help brands significantly decrease the number of duplicate and fake accounts. For AIQFOME, this is the best way to maintain revenue that was being lost by their partner restaurants.

Alternatives to text verification

There are many other authentication methods besides text verification.

Many businesses do not use text verification. Below are other authentication methods that they commonly use:

Flash call: This way often used in markets where SMS costs are very high. It makes an automated call to the user’s mobile device and uses a randomly generated number as a one-time code for quick and easy verification.

Data verification: It compares the end user’s phone number with a special code or token linked to their mobile data session. This method takes advantage of mobile operators’ subscriber data and verifies a user’s identity without requiring them to enter a PIN or any private information. Because verification happens behind the scenes, the risk of errors and social engineering is removed.

Voice verification: This way sends an incoming call with a voice delivered by text-to-speech software that reads the code. After that, the user enters this code into a platform or system for access.

Email verification: Similar to the above method, it sends a verification link or code to a user’s email address provided for confirmation. This verification is available through Sinch’s enterprise-grade email solution – Mailgun Optimize.

As for the ways to verify by flash calls, data verification, voice verification, and SMS verification tools, Sinch offers a general solution called Verification API. With failover functionality, the solution automatically converts to alternate methods if one fails.

What’s the difference between 02 text verifications: SMS and email?

Both of these authentication methods are used to verify a user’s identity.

Both of these authentication methods are used to verify a user’s identity but use different channels to accomplish that goal. Email verification sends a confirmation link or code to a user’s email address. But SMS verification typically involves a text message with a code to a user’s mobile device. You should combine these authentication methods to give you the best protection and experience.

How to choose a text verification service

There are some criteria to help you choose a text verification provider.

Many companies are providing SMS text verification services out there. So how do you choose the best one? Here are some criteria to help you choose a provider:

Security compliance: When choosing suppliers, make sure they have multiple data centers in different locations (just in case something goes wrong!) and are certified by PCI and ISO27001. This means they follow the best security policies and have a hard plan to protect your business information.

Fast and reliable delivery: OTP has a time limit. Users often only have a few minutes to enter them before they expire. That’s why you should seek an SMS API that can increase the time without affecting speed.

Reliable fallback verification: While Text messages are a very popular method sometimes they can’t be delivered due to temporary disruptions. You should search for a provider that offers different methods if SMS messages fail to be delivered or if costs are too high. Alternatively, make sure that the provider offers methods through other channels like WhatsApp or email to ensure the verification process does not encounter any troubles.

Until now, the only way to prevent fake accounts is through login information including username and password. This single layer of security just isn’t enough to protect users in today’s world, where fraudsters and hackers are becoming more and more sophisticated. Luckily, there are tools like text verification that can help you verify your users’ identities before granting access such as SMSVERIFICATIONPHONE.COM .

We are always committed to your security and privacy when you access the Website. The text verification service we provide always ensures the criteria of speed and authenticity. With an extensive international information store, we certainly provide the best verification method that matches your needs.